Ivane Javakhishvili Tbilisi State University

Paata Gugushvili Institute of Economics International Scientific

DEMOGRAPHIC TRANSITION AND CHALLENGES OF PROVIDING PENSION COVERAGE TO ALL

Annotation. The article reviews analytical literature on the demographic challenges worldwide. The article aims to contribute to the debate over the increasing necessity to improve social security of elderly workers and retirees both in developed and developing countries. The ways to make government-led pension systems sustainable should be discussed further as well as the alternative ways to improve private efforts focusing on ensuring financial inclusion of workers.

Nowadays most countries are seeing significant population aging. Population ageing as a global demographic trend has already influenced social processes, patterns and structures such as labor, family, work and employment, etc.

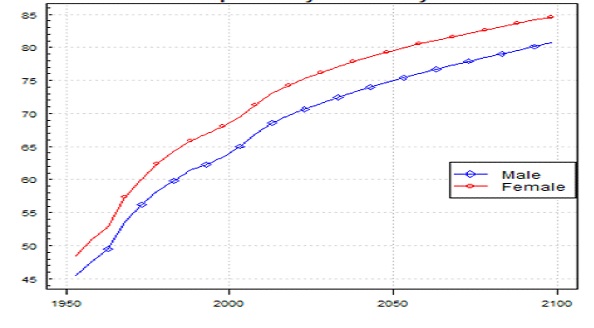

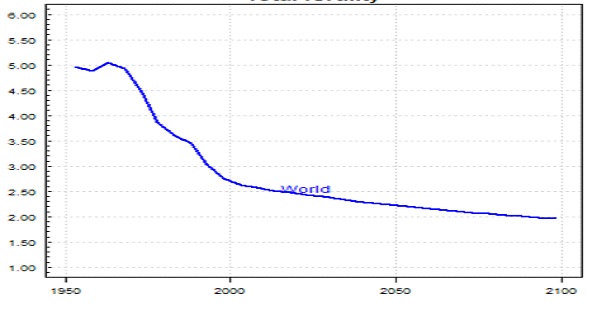

The relevant literature concludes that population ageing is due to increasing longevity; low and below-replacement rate fertility and, also emigration trends that significantly impacts in particular smaller countries, for instance in Eastern Europe (OECD, 2013). Figure 1 and Figure 2 show the trends in life expectancy and fertility rates.

Figure 1. Life expectancy at birth by sex, 1950 – 2100.

Data source: United Nations

Figure 2. Total fertility, 1950 – 2100.

Data source: United Nations

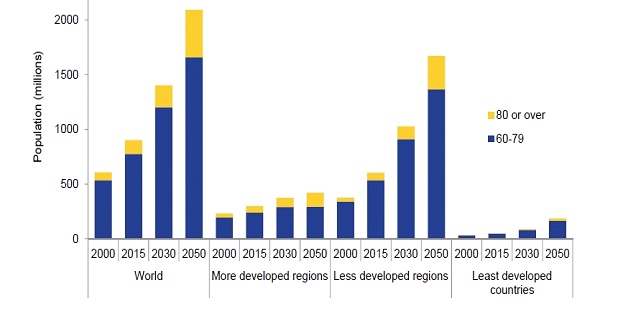

Population aging trends look rather critical in the context of most effected regions and countries. According to the recent reports published by the United Nations the global population aged 60 years or over numbered 962 million in 2017 is expected to double by 2050, when it is projected to reach nearly 2.1 billion (see Figure).

Figure 3. Population aged 60-79 years and aged 80 years or over by development group,

2000-2050

Data source: United Nations

What is also very important, the number of oldest-old (persons aged 80 years or over) around the world is growing at the fastest rate and is projected to increase more than threefold between 2017 and 2050, rising from 137 million to 425 million. In 2050, older persons (60+) are expected to account for 35 percent of the population in Europe, 28 percent in Northern America, 25 percent in Latin America and the Caribbean, 24 percent in Asia, 23 percent in Oceania and 9 per cent in Africa (UN, 2017 and UN, 2022).

At the same time life expectancy at age 60 is increasing in all country groups and regions and the old-age dependency ratios will almost double by 2050 in a vast number of developed and emerging countries. If there is a higher life expectancy in the future it would definitely mean that life for most populations throughout the world will become more expensive because of increase in health and care costs at older ages. This means that ageing trend worldwide may come along with more severe and persistent poverty, as many can easily fall into poverty after they stop working. The International Actuarial Association (2016) highlights that worldwide longevity, and particularly healthier longer lives, are greater for people in higher socioeconomic groups. This evidence suggests that poor and vulnerable elderly in developing, emerging, and developed countries will demand more financial support than today (WB, 2011; UN, 2010).

While there is a clear need to improve the position of both current and future vulnerable old-age populations through social protection contributory and non-contributory tax financed schemes, fiscal consolidation or austerity pressures in most developed, emerging and developing countries continue to jeopardize the long-term adequacy of pensions (ILO, 2017).

The ILO Social Protection Report (2017) highlights that the vast number of countries including the most developed are proposing parametric and systemic reforms aiming to achieve fiscal sustainability of their pension systems, though they lack the potential to maintain pension adequacy in the future, and if nothing is done the future beneficiaries will be less better off or simply will get poor. The report highlights that in most developed countries with comprehensive and mature systems of social protection, the main challenge with ageing populations is to maintain a good balance between financial sustainability and pension adequacy.

A number of research studies suggest that in most OECD countries future retirees will face greater financial risks. Most people are already not saving enough, and ageing makes managing their finances harder for them. For instance, in the US, while the majority of current retirees can weather shocks such as high medical bills, future retirees would be much more vulnerable to such shocks (CRR, 2018).

Not surprisingly, the situation is harder in less developed economies that are facing structural barriers linked to development, insufficient fiscal space, high levels of informality, poverty, low contributory capacity, and are still struggling to develop and finance their pension systems.

It is worth to mentioning that the trend related to the decline in intergenerational system of family support is becoming more and more obvious even in younger developing and emerging economies.

Most governments don’t directly influence demographics. But they implement changes to welfare programs, social insurance programs, social security programs, disability insurance programs, healthcare programs, long-term and end-of-life care programs, labor and employment programs, and what is of crucial importance, they undertake measures to improve access to financial inclusion. Consequently, the main challenge for both developed and developing world is to make policy efforts to implement either effective public or private services to provide financial security in old ages for the most vulnerable workers.

References

IAA 2016. Pensions, Benefits, and Social Security. Available at: Home (actuaries.org)

CRR 2018. “Will the Financial Fragility of Retirees Increase?” By Steven A. Sass. Available at: Will the Financial Fragility of Retirees Increase? | Center for Retirement Research (bc.edu)

ILO 2017. World Social Protection Report. Universal Social Protection to Achieve Sustainable Development Goals 2017-2019.” Geneva.

OECD 2013. Coping with emigration in Baltic and East European countries. Available at: Coping with Emigration in Baltic and East European Countries | OECD iLibrary (oecd-ilibrary.org)

OECD 2018. “Pensions at a Glance. Asia and Pacific.” Publishing OECD, Paris, France.

UN 2017. “World Population Aging Report”. Available at: http://www.un.org/en/development/ desa/population/ publications/pdf/ageing/WPA2017_Highlights.pdf

UN 2010. “World Population Ageing”, Department of Economic and Social Affairs, Population Division. Available at: World Population Ageing 2009 | Latest Major Publications - United Nations Department of Economic and Social Affairs

UN 2022. World Population Prospects 2022. Available at: World Population Prospects - Population Division - United Nations

WB 2009. “Is Latin America: Ready for an Aging Revolution?” Available at: Latin America: Ready for an Aging Revolution? (worldbank.org).